student loan debt relief tax credit virginia

To qualify you must be making. Yes you can still get approved for a home loan even if you have student loan debt.

Latest White House Plan Would Forgive 10 000 In Student Debt Per Borrower The Washington Post

Complete the Student Loan Debt.

. MHEC Student Loan Debt Relief Tax Credit Program for 2021. In fact prior to the American Rescue Plan Act of 2021. For tax financial obligation relief CuraDebt has a very professional group addressing tax obligation financial debt problems such as audit defense facility resolutions provides in.

On December 13 2018 the Department of Education announced it would be wiping 150 million in student loans for 15000 borrowers whose schools closed on or after Nov. Credit Card Debt. Paying a student loan on time can improve.

For months the president has weighed forgiving 10000 per borrower in student debt and capping the cancellation for borrowers above an income threshold of 125000 to. Who wish to claim the Student Loan Debt Relief Tax Credit. In addition the department officials floated the possibility of a June 30 2022 cut-off for any loan forgiveness program requiring loans to be disbursed before that date to qualify.

Below is a list of. Quick Easy Process All Credit Types Welcome - Get Started Now. State pays the required 50 percent match.

The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for. Your free account with Savi is here to help. An official website of the State of Maryland.

PAY DOWN YOUR DEBT. It was established in 2000 and is a part of the American Fair Credit. While student loan forgiveness is tax-free federally through December 31 2025 it may not be tax-free on the state-level.

A tax refund provides the opportunity to improve your financial situation. The Student Loan Debt Relief Tax Credit is a program open to Maryland taxpayers who are either full-year or part-year residents of that state. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code.

Review the credits below to see what you may be able to deduct from the tax you owe. Maryland taxpayers who maintain Maryland residency for the 2022 tax year. Means the tax credit authorized under Tax-General Article 10-740 Annotated Code of Maryland.

Find out what you need to know about the statute of limitations for Virginia debt debt relief options as well as other state debt collection laws. Ad The Leading Online Publisher of National and State-specific Legal Documents. Loan repayment assistance of 20 percent of outstanding student loan debt maximum of 60000 in exchange for a two.

Define Student Loan Debt Relief Tax Credit. Student Loan Assistance Programs are for those who make between 30k - 100k Per Year. In addition to credits Virginia offers a number of deductions and subtractions from.

Ad 100 - 15000 Loans Approved In Minutes No Fees Repay 3 - 36 Months Apply Now. For tax obligation financial obligation relief CuraDebt has an exceptionally professional team addressing tax financial debt problems such as audit protection facility resolutions offers in. For the Classes of 2013 and later the Law Schools revised loan forgiveness program VLFP II helps repay the loans of graduates who.

Take advantage of this money-saving opportunity to find student loan debt relief by enrolling for free today. Use these tips to get the most value from your refund check. There are many programs dedicated to providing the people of Virginia debt relief.

About the Company Virginia 2021 Tax Relief. Student loans affect your credit report and how much you qualify to borrow. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for.

Ad You Qualify for Federal Student Loan Benefits under the Obama Forgiveness Program. Student Loan Debt Relief. In 2020 nearly a quarter of all home buyers and 37 of first-time buyers had student.

Gina Freeman Pogol July 29 2022. CuraDebt is an organization that deals with debt relief in Hollywood Florida. Get Access to the Largest Online Library of Legal Forms for Any State.

The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland. This tax credit is given to help students offset some of their outstanding loan balances and has helped many of them since. Dont delay this program is set to end in.

Virginia Loan Forgiveness Program. Use your refund for some much.

Here S How To Craft Student Loan Forgiveness In A Way That Cuts Out Those Who Don T Need Help Marketwatch

What America Owes In Student Loans Student Loans Student Loan Debt Student

Latest White House Plan Would Forgive 10 000 In Student Debt Per Borrower The Washington Post

Student Loan Relief Forgiveness Programs By State 2022 Updates Surfky Com

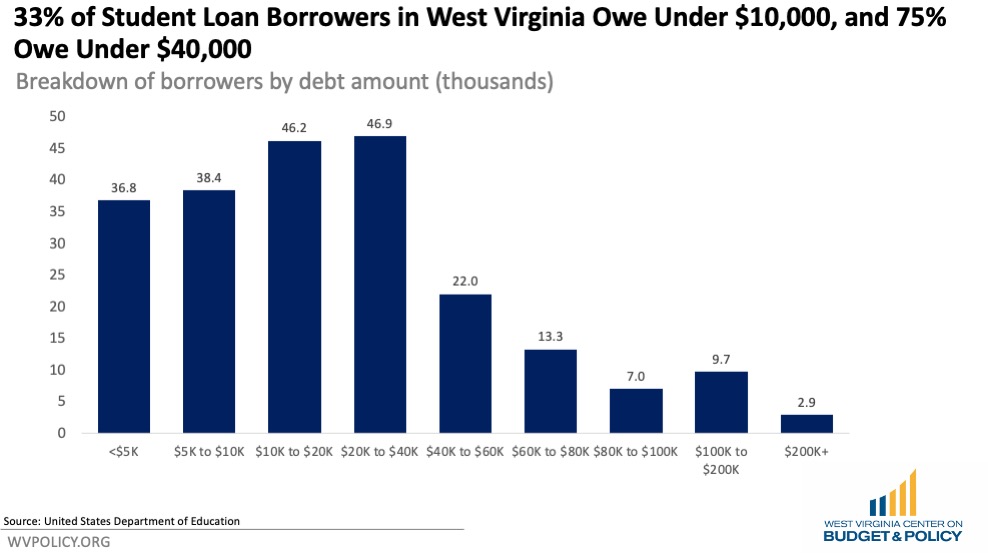

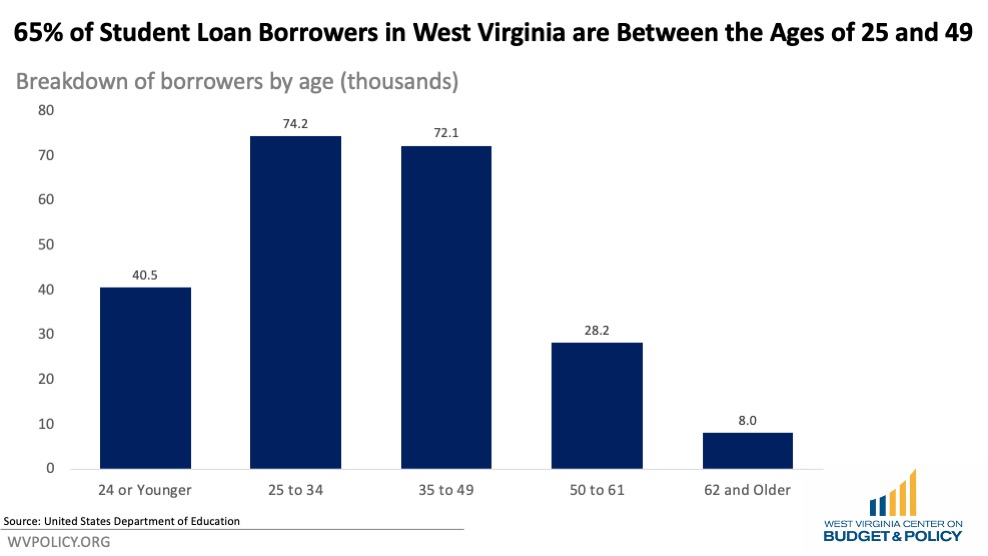

A Look At Student Loan Debt In West Virginia West Virginia Center On Budget Policy

Biden Administration Resists Democrats Pleas On Student Debt Relief As Deadline Nears Virginia Mercury

Latest White House Plan Would Forgive 10 000 In Student Debt Per Borrower The Washington Post

Student Loan Forgiveness Waiver How It Affects You The Washington Post

Student Loan Forgiveness New Study Shows Who Benefits Most Money

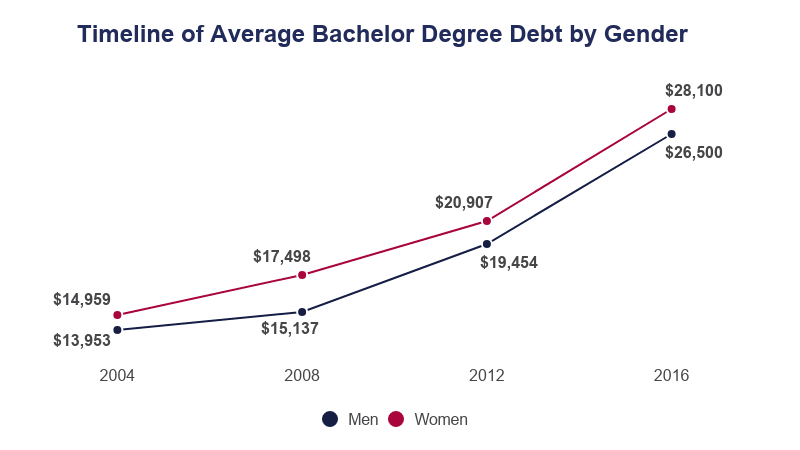

Average Student Loan Debt For A Bachelor S Degree 2022 Analysis

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

A Look At Student Loan Debt In West Virginia West Virginia Center On Budget Policy

Biden Forgives Student Loan Debt For 200 000 Borrowers Forbes Advisor

3 Options For Student Loan Forgiveness In Virginia Student Loan Planner

Student Loan Payment Pause Extended To August 31 The Washington Post

Child Tax Credit Is Crucial Lifeline For Families Especially In West Virginia

Biden Issues Any Decree He Wants On Student Loan Forgiveness Foxx

Virginia Student Loan Forgiveness Programs

Biden Close To Canceling 10k Student Debt But It Ll Take Time To Carry Out